A successful home buying experience is achievable due to the details. It is by ensuring all of the details from the start of the process to the finish are right. Everyone has their reasons for buying a house. However, they all have to go through the same process to find a property they will call their home. Purchasing your first home can be a thrilling experience. It is also one overshadowed by intimidation about the process.

Know Your Credit Score

Get a copy of your credit score before you begin looking for a house. Your credit score has an impact on determining the interest rate you can get for your loan. The higher your credit rating, the more likely it is to obtain a loan to buy a house at a lower interest rate. Ensure that you review your credit score carefully before applying for a loan. It is not unusual for there to be mistakes included in a credit report. These mistakes can often bring your credit score down.

Selecting The Right Mortgage Lender

There are a variety of mortgages available, varying in down payments and eligibility requirements. You also have options about the mortgage term. Request loan estimates for the same type of mortgage from multiple lenders. You can compare the costs, including interest rates and potential origination fees. Choosing the right home loan experts can make a difference. Check all of the mortgage options available to you.

Know The Commute Times

Purchasing your first home is both an investment and lifestyle decision. Consider the time it will take you to commute to work. Test-drive the route you would take to work during commuting hours. If you work unsociable working hours, see if there is transport available.

Consider The Location

If you have young children or planning to become parents, school quality is an important factor worth considering when buying a home. School rankings are not always the best indicator for performance as they can quickly change. Look at the school budget history of towns you are interested in buying a house. Note if residents have prioritized funding for education. There are city statistics available to provide greater insight.

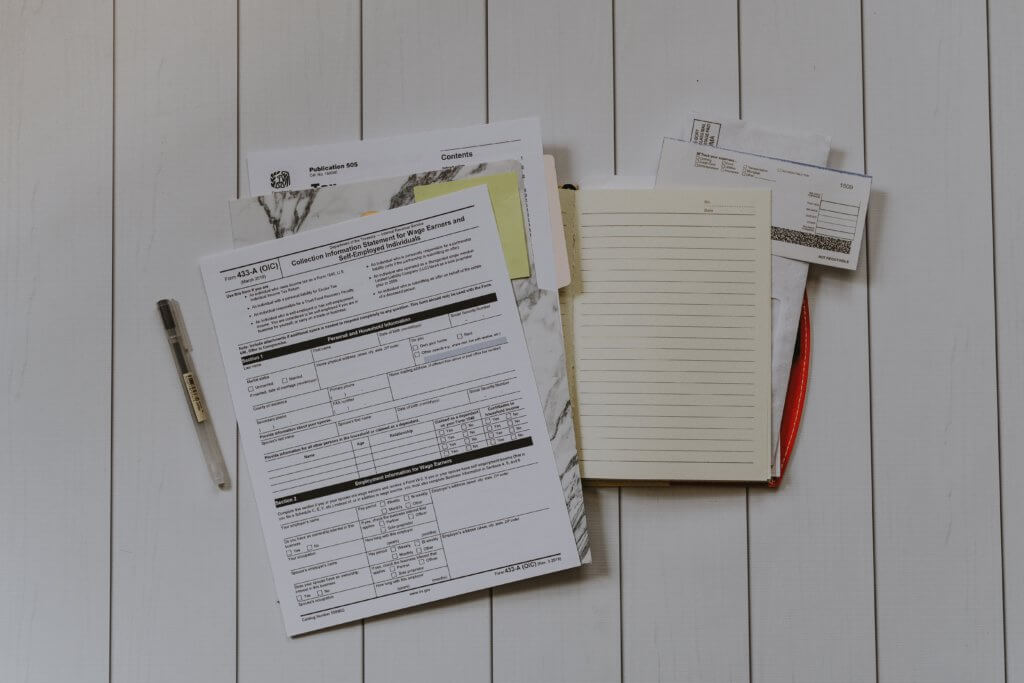

Remember The Additional Costs

Aside from down payments, there are closing costs to cover before you have ownership of your home. Closing costs are the fees and expenses that need paying to finalize your mortgage. They range in percentage of the loan amount. You will also need additional funds after purchasing your home. The additional funds are for immediate home repairs (that can be fixed by Handyman Toronto), upgrades, and furnishings you want on the house. Invest in adequate homeowners insurance before closing the deal. It will cover the costs for any repairs or replacements to your home and belongings if damaged by an incident covered in your policy.

Buying your first home is about the journey to the desired destination. Take your time to ensure the best results for you. Plan and enjoy exploring this new phase in your future. You will be grateful you did when living in your own home.

It’s important to do all your research before committing to buying a home. Location is key especially for those with children.

It really is!

Buying a home is such a big decision and an investment. It is good to be prepared with some good tips and information.

It is! It’s quite scary.

We JUST bought our first home two weeks ago. There was so much we didn’t know!

Oh wow congratulations!

These are all great things to consider, especially the credit score. This is something myboyfriend and I had to think about when we bought our house last year.

Yeah, there is a lot that goes on!

All good tips. Buying a home is a huge deal so it’s important to plan.

It is a huge decision.

Some great tips here! Selecting the right mortgage lender is so important, and most new home owner should spend time to research it well

Yeah, there is a lot of research that goes into it.

I think it’s important not to forget the additional costs when buying a house. As these are often forgotten about

Yes!

I always consider my commute life when I move. Very important tip!

You never want to be taking just as long to get to work as being at work.

Such great tips here for anyone buying their first home. Thank goodness we ahve done this and the process is over as it can be exhausting 😉

It can be such a complex and draining process indeed.