In an era where technology intersects with every aspect of daily life, financial technology, or fintech, is making significant inroads into how individuals manage their personal finances. For students, whose financial situation can often be precarious and learning-intensive, fintech apps offer a powerful tool for navigating their monetary responsibilities more efficiently. From budget tracking to investment learning, these apps not only simplify financial tasks but also teach vital money management skills.

Managing finances while balancing academic demands can be overwhelming. This is where fintech apps come into play, designed to streamline budgeting and spending for those juggling deadlines and exams. For students looking to ease their academic load with professional support, writing services where they can ask EssayService help me write an essay to provide valuable time-saving benefits, allowing more focus on learning about personal finance management.

How Fintech Apps Benefit Students

Simplified Budget Management

A major benefit of fintech apps is their ability to assist students in monitoring their financial activities. These apps often feature user-friendly interfaces that allow users to categorize their spending, track their budgets, and set financial goals. This ease of managing money is especially advantageous for students taking charge of their finances for the first time.

Enhanced Savings Strategies

Many fintech applications offer automated savings features, which help students set aside a portion of their money without having to think about it. These tools can be crucial for building emergency funds or saving for future expenses like spring break trips or textbooks, making it easier to maintain financial stability throughout school years.

Improved Credit Score Awareness

Credit management is a critical skill for any college student, especially for those planning to take out loans or finance major purchases post-graduation. Fintech apps often provide credit score monitoring and tips for improving credit health, educating students on how important maintaining a good credit score is and how it can be achieved.

Access to Financial Education

Learning about finances goes beyond just keeping a budget. Fintech apps frequently include educational resources that cover various aspects of personal finance, such as investing, debt management, and more. This educational component is vital for students who may not receive this training as part of their college curriculum.

Convenient Digital Payments

As more students embrace digital solutions for both their learning and personal needs, the convenience of fintech apps that facilitate easy peer-to-peer payments and digital transactions cannot be overstated. These apps allow students to split bills, pay rent, or even pay down debts without the need for cash or complicated banking processes.

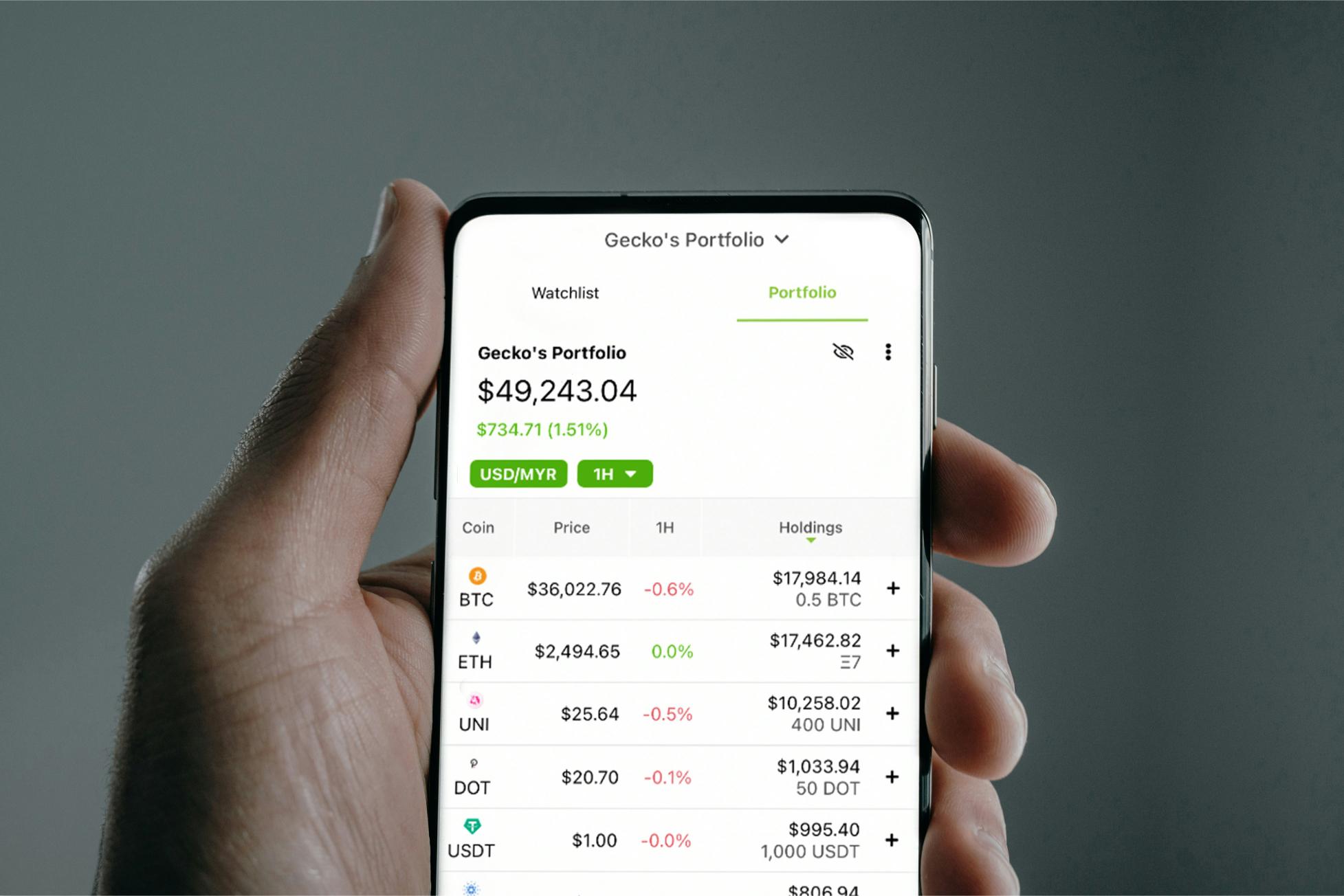

Top 5 Fintech Apps for Students

Here’s a rundown of the top five fintech apps that are making a difference in how students manage their money:

- Mint

Mint, a widely used budgeting app, enables students to monitor their expenditures and maintain financial goals by consolidating all financial accounts in one location, thus providing a detailed view of their financial health. Mint also offers tailored advice and insights to enhance users’ spending and saving habits.

- You Need a Budget (YNAB)

YNAB focuses on giving students a proactive approach to managing their money. It teaches the importance of giving every dollar a job, helping users plan their spending before it happens. The app also offers real-time tracking tools that adjust as income and expenses change, ensuring budgets always reflect current financial situations.

- Acorns

Acorns suits students ready to start investing by automatically rounding up purchases to the nearest dollar and investing the spare change, simplifying the process of building wealth early on. Acorns also educates users on investment basics through its built-in learning platform, catering to young investors.

- Venmo

Predominantly used for splitting bills and sending money between friends, Venmo combines social media with financial transactions, making it a must-have for students who share expenses with classmates. The app also features a social feed where users can see friends’ payment activities, adding a fun and engaging element to transactions.

- Credit Karma

Apart from offering free credit score checks, Credit Karma provides insights into how students can improve their credit scores and potentially save money on interest rates in the future. The app also monitors users’ credit reports for any changes or unusual activity, helping to protect against identity theft and fraud.

Conclusion

Fintech apps offer a host of advantages that can help demystify the complexities of financial management for students. By integrating these tools into their daily routines, students can not only enhance their financial literacy but also take proactive steps toward a more secure financial future. Whether it’s through better budget management, building savings, or learning about credit health, fintech is undeniably reshaping the financial landscape for students everywhere.

As fintech continues to evolve, so too will the opportunities for students to manage their finances more effectively, ensuring they can focus on what really matters: their education and future career prospects.

I love that the apps include financial education. Knowing how to use money only works if you KNOW HOW to use money.

These are amazing apps…I use Mint a lot, it is extremely convenient. I need to check the other ones.

Much needed information! This is such a helpful breakdown of how fintech apps can make managing money easier for students. I thank you for sharing these great apps. I am gonna recommend this post to many people who need to read this

I’m glad to see there are apps to help young people learn about managing their money. This is an important part of their life as they get into the working world.

I love apps like this that help out in a big way! I didn’t know about this app so I appreciate the heads up and all the information you provided on it.

This sounds like it would be a really useful app for students to learn to manage their finances. It will come in handy when my eldest goes to university.

Apps like this are so helpful – especially for helping with budgeting. And it is so important for students to learn this!

Was not aware of how fintech apps can benefit students. I hope they make

managing their money a lot easier.

Fintech apps are definitely changing the way students manage their money. An informative read for sure!